Small business ownership entails risk. Certain risks, such as launching a new business or hiring an unproven person, can provide unexpected rewards.

It can be challenging to find the perfect Business Accountant in Melbourne. That's why we've compiled a list to assist you.

Hillyer Riches - Business Accountants Melbourne

0395 715 334

Hillyer Riches are tax accountants & business advisors in Caulfield East, Victoria, that provide accounting, bookkeeping, taxation, and business advisory services in the Melbourne area for individuals, businesses, investors, and self-managed superannuation funds (SMSF).

EWM Accountants & Business Advisors - Business Accountants Melbourne

0395 685 445

EWM Accountants and Business Advisors are Chartered Accountants helping small businesses with their accounting, bookkeeping and taxation needs. Established more than 30 years ago, we are experts in helping small businesses and specialise in construction, investment, medical, dental and manufacturing industries. Based in busy Oakleigh in Melbourne, the firm is made up of a group of expert accountants who bring a wealth of experience to help fulfil our vision.

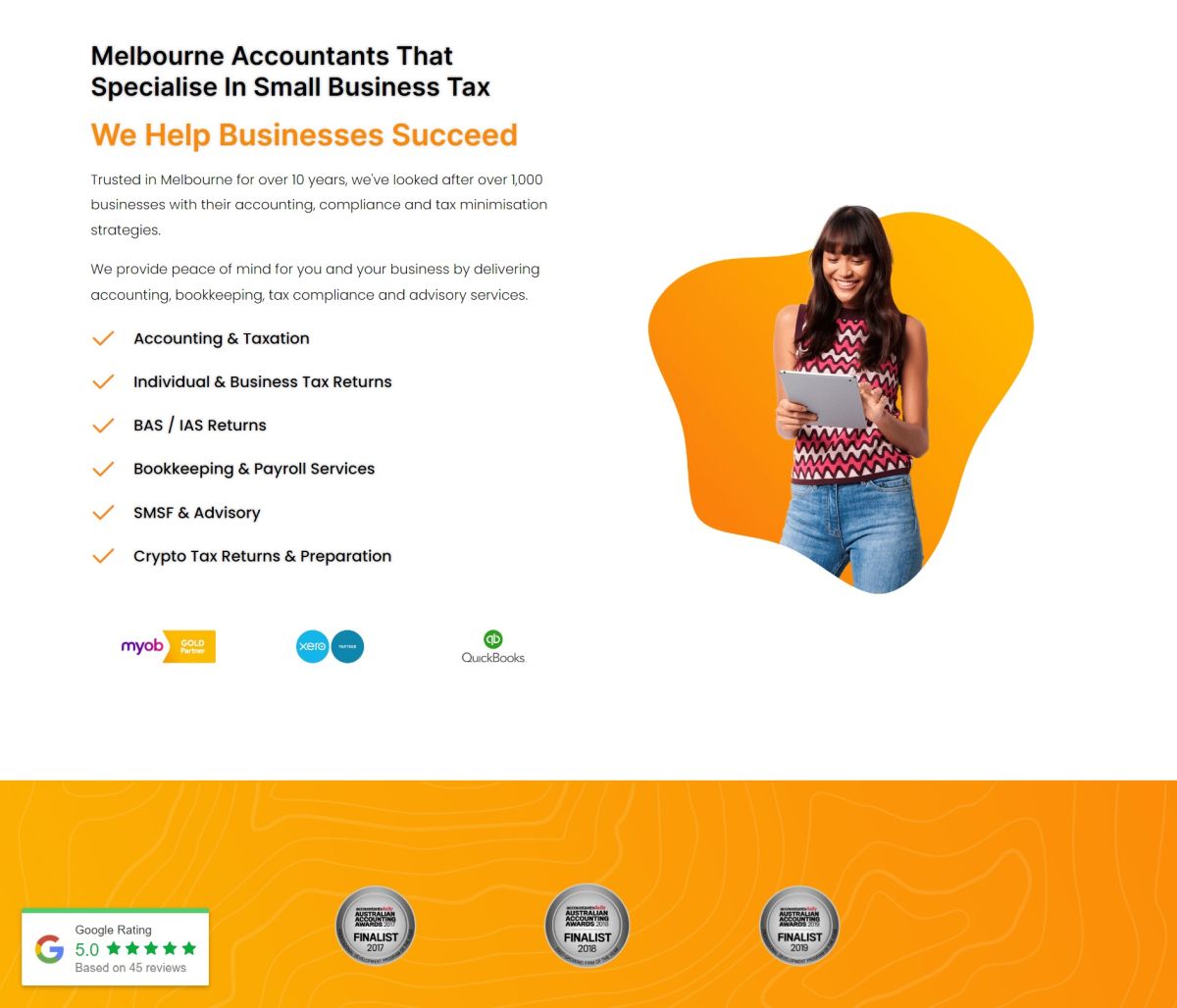

Bookkept - Business Accountants Melbourne

0385 683 607

Bookkept is a cloud-based tax and business advisory firm located in Melbourne, servicing clients Australia wide. We offer a comprehensive range of accounting and business advisory services tailored to meet all accounting requirements across a wide range of industries.

Tax Window - Business Accountants Melbourne

Tax Window, a prestigious accounting firm located in Melbourne, is dedicated to aiding individuals and businesses in attaining their financial objectives. Employing a strategic methodology, they differentiate themselves by entrusting client management to senior accountants, boasting a remarkable 30-year history. Noteworthy is their transparent pricing model, a deviation from conventional fee structures prevalent in the accounting profession.

Services Offered:

- Property Consultation

- Advice on SMSF (Self Managed Super Fund)

- Small Business Accounting

- Specialized services for various industries including builders, cafes, franchises, tradies, startups, plumbers, medical practitioners, restaurants, bars, and.

- Investment Planning

- Business Advisory

- Tax Agent Services

Contact Details:

Website: https://www.taxwindow.com.au/

Address: Level 1/441 South Rd, Bentleigh VIC 3204

Operating Hours: Mon-Sun 9:00-18:00 (By Appointment)

Phone: 03 9999 8538

Email: info@taxwindow.com.au

FAQs About Business Accountant

What Will an Accountant Do for me?

- Help with filling in tax forms correctly.

- Help with minimising your tax bill.

- Help with planning your tax liability ahead.

- Help with your personal finances.

- Help with growing your business.

- Help with making business decisions.

- Help dealing with problems.

- Help with saving time.

An Accountant helps businesses make critical financial decisions by collecting, tracking, and correcting the company's finances. They are responsible for financial audits, reconciling bank statements, and ensuring financial records are accurate throughout the year.

Those with a single employer and few investments may save hundreds of dollars by preparing their own taxes, while those with business income or rental properties will find the expense of hiring an accountant to be worth their peace of mind and potential tax savings.

Every two to three years

Other than the reasons above, it is advisable to look at your options when it comes to accountants every two to three years is recommended to ensure your current accountant is competitive with both the fees and the services it provides.

Bookkeeping is a foundation/base of accounting. Accounting uses the information provided by bookkeeping to prepare financial reports and statements. Bookkeeping is one segment of the whole accounting system. Accounting starts where the bookkeeping ends and has a broader scope than bookkeeping.

Illumin8 - Business Accountants Melbourne

0397 876 873

On the Mornington Peninsula, I'm looking for an accountant or bookkeeper. Nice. There are quite a few of us kicking around. However, are you seeking someone to deliver a shoebox full of receipts just before the October tax deadline? We're not like that. That may be true, but we accomplish so much more.

We're a group of forward-thinking accountants, bookkeepers, and business advisors who operate in the cloud. We will develop new and better ways to do things specific to your business, using a customised and practical approach, compassion, and understanding. This could include working on your business tax return, budgets, and financial projections, or even a monthly meeting to discuss your long-term objectives.

What's the best part? We can take advantage of breakthrough tech solutions that ease the management of your business finances because our cloud accounting is powered by Xero. Some even say it's enjoyable.

ACCOUNTANTS FOR YOUR TOMORROW

Nobody wants to think about accounting for a small business. However, everyone must participate. A professional accountant will become your trusted ally and advisor on the rollercoaster ride of running a business, more than just keeping your accounts in control and documentation filed on time. That's us. We're here to keep you out of jail (more on that later) and help you score goals so you can spend more time doing the things you enjoy.

We're professionals in recording and interpreting financial data as a group of number-loving accountants and tax specialists, business advisors, and bookkeepers. But you're after more than simply conformity, aren't you?

Perhaps you're looking for an accountant that genuinely cares about you and your company, and this is just a guess. Someone who will spend the time to learn your particular requirements (and even the items you didn't realise you required) and come up with new and better methods to do things.

We like to think of accounting compliance as the portion that keeps you out of jail. However, that is merely the basic minimum. With accounting and advising services, we're here to support your mission and vision. And make sure you have fun while doing it.

The Illumin8 accounting crew has arrived. Our award-winning team is here to make taxes easier, match your numbers with your purpose, and provide strategic counsel to help you reach your objectives.

Rogerson Kenny - Business Accountants Melbourne

0398 022 534

Rogerson Kenny Business Accountants Melbourne is dedicated, focused, and dynamic team that specialises in bookkeeping, accounting, taxation, and business consulting.

They want to help you build your business, not merely comply with regulations. Rogerson Kenny Business Accountants Melbourne works with their clients to help them reach their financial goals by enhancing the way they manage their businesses - boosting their value, increasing profit and cash flow, and bringing new ideas to the table. Their dedicated, high-performing team is here to assist you.

Rogerson Kenny Business Accountants in Melbourne concentrate on the demands of their clients. Everything they do, from hiring to planning to technology investments, is geared at assisting you in reaching your financial objectives. Rogerson Kenny Business Accountants Melbourne is better positioned to assist their clients — businesses that want to expand, become more efficient, lucrative, and saleable – because they are clear on what they do and the services they give.

Rogerson Kenny Business Accountants is a dynamic and ever-changing firm. They put a lot of money into IT and streamlining its systems and operations. The workforce at Rogerson Kenny Business Accountants Melbourne is empowered to enhance the company. They employ cutting-edge technology and quality assurance methods to ensure that they constantly produce high-quality work.

Their clientele is primarily privately held, employee-owned enterprises that require tax, accounting, and business guidance.

Business Advice

We work with you to design a business strategy to assist you in reaching your goals by understanding your goals and presenting business performance, business structure, and strategy.

Financial Accountability

We work with you to take your business ahead, usually monthly, to a set of measurements / KPIs via a dashboard and financial performance statistics. This is more than just a tax and accounting firm.

- Budgeting and reporting

- Three-way forecasting (Balance sheet, profit & loss, cash flow)

- KPI measured on the dashboard

CFO Services

Why buy a full-time CFO when you can use us on a part-time basis? Use our experience to cut through and enjoy an efficient accounting and reporting process.

- Managing cash flow

- P&L management

- Oversee payroll, superannuation, and bookkeeping function, debtors, accounts payable

- Handling / overseeing all regulatory compliance (BAS, IAS, etc

- Overseeing key payments (insurance, finance, etc.)

Bank Finance

- We can assist you with obtaining and reviewing bank finance, including:

- Finance when buying a business

- Refinancing

- Finance for growth or further acquisition

Cloud Accounting | Xero Accounting Software

We are Xero Gold partners and can assist all things Xero and cloud accounting.

- Set up of Xero

- Transition existing bookkeeping software to Xero

- Payroll, Invoicing assistance

- Training

- Troubleshooting

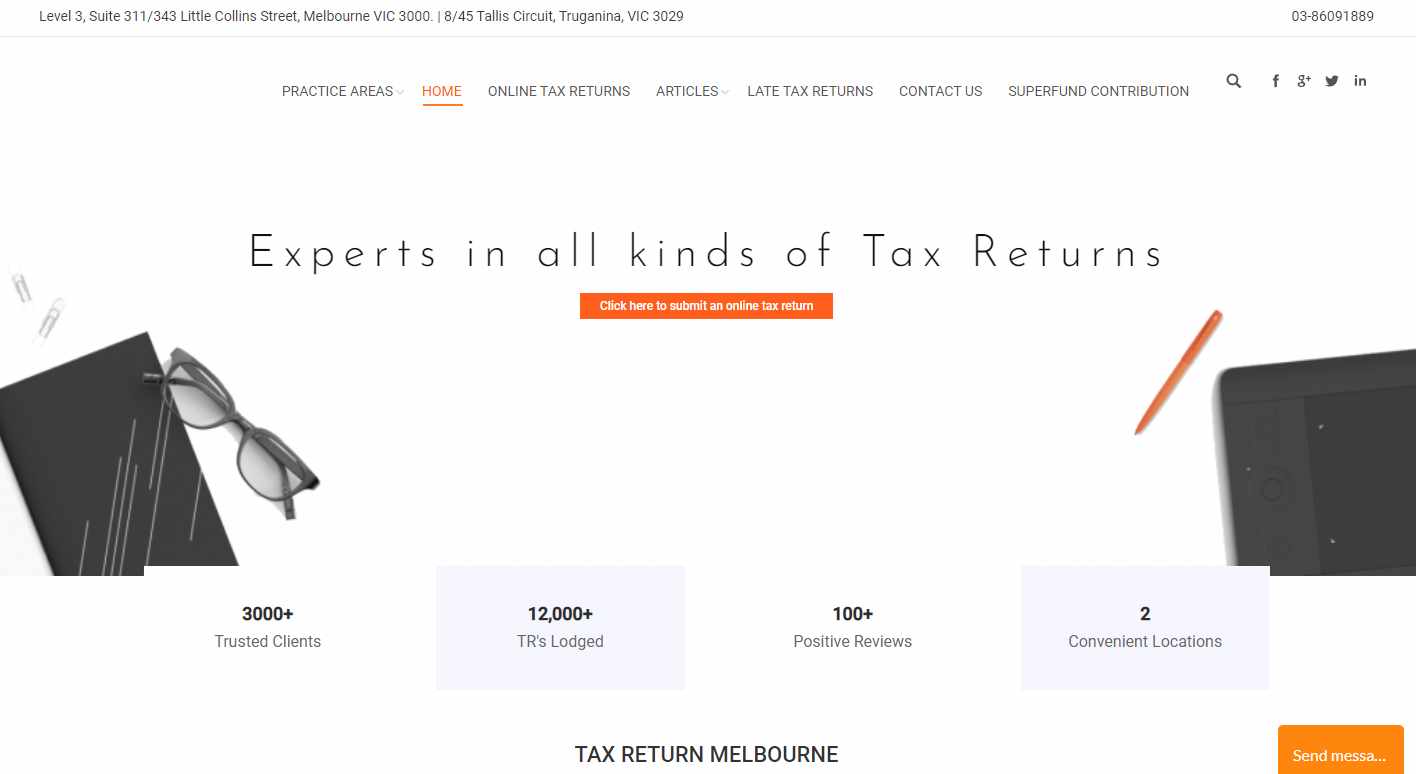

A-One Accountants - Business Accountants Melbourne

0386 091 888

We are a small Melbourne-based team of accountants who are passionate about all things accounting and tax. All of our accountants hold a bachelor's degree from an Australian university and undergo ongoing training and coaching to stay up with the ever-changing tax and accounting scene.

ACCOUNTING & BOOKKEEPING:

We offer accounting and bookkeeping services to businesses of all types, including sole traders, partnerships, corporations, and trusts. A combination of these structures is sometimes utilised. Among our services, but not limited to:

- Bank reconciliations.

- Accounts Receivables, Accounts Payables & Invoicing

- Payroll & Payment Summaries.

- Cash Flow statements.

- Profit & Loss Statements.

- Balance Sheets.

- Financial Statements.

- Trust & Client Accounts.

- Set Up and administration of an accounting system.

TAX ACCOUNTANT MELBOURNE

We are a group of tax accountants with extensive experience in individual tax accounting as well as commercial tax accounting in a variety of industries. Our tax accountants and tax consultants have degrees from Australian universities and are driven and eager to assist you with your tax issues. They are subjected to intensive and ongoing training in order to stay current with regulations as well as client requirements. We are Xero and Quickbooks expert tax accountants in Melbourne as a team.

M.A.S Partners - Business Accountants Melbourne

0388 661 554

M.A.S Partners (previously m.a.s accountants) has been providing accounting and consultancy services to Sydney, Melbourne, and Australian small businesses for over 55 years as Australia's pioneer accounting firm for small businesses.

Our accounting services enable our clients to focus on growing their businesses, with locations in Melbourne and Sydney and a dedicated staff of experienced small company accountants and advisors. Business accounting is our expertise, having worked with a variety of clients who all have various needs, ranging from accounting basics to tax accounting, payroll administration, accounts payable and accounts receivable support.

Doctors, dentists, construction companies, restaurants, investors, self-employed tradespeople, pharmacies, retail stores, marketing advisers, architects, interior designers, solicitors, and a variety of other professionals are among our clients.

We are the original, having started in 1961. The needs of small firms, as well as their accounting and advising requirements, have changed substantially over the last 58 years. We've changed and evolved over time, always keeping our customers at the centre of our operations.

Your time is too valuable to be spent on small business accounting, according to history. M.A.S Partners, your small business accountants, can handle the complicated and burdensome aspects of your accounting.

Our Services

Accounting for small businesses is our strength!

As Australia's first small business accounting firm, we've worked with a wide range of clients with varying needs, from providing accounting basics and acting as their trusted tax accountant to providing comprehensive services such as payroll management, accounts payable and receivable assistance, and personalised advisory services.

Take a look at our core services below to find out more about how we can make your life easier.

Compliance

- Taxation

- Return Preparation

- Reporting

- Lodgements

- Advice

Business Services

- Payroll

- Accounts Payable

- Accounts Receivable

- Bank Reconciliation

Advisory

- Reporting on ATO Industry Benchmarks

- Cash Flow Analysis

- Budgeting

- KPI Analysis of your Business

- Goal Setting and Reporting

RBizz Solutions Corporate Tax Accountants & Business Advisors - Business Accountants Melbourne

0130 0072 495

Raj decided to start an accounting firm with the main goal of making the financial and technological expertise of large corporations available to small and medium businesses at affordable prices through a perfect partnership between professional expertise and AI technologies after a long association with global businesses in a variety of industries in a variety of senior finance and operations roles.

The most significant problem that small firms confront is obtaining high-quality professional services at reasonable pricing that are justified in terms of benefits. Raj's goal is to solve this problem by creating new tools that allow him to quickly share his knowledge with a larger number of enterprises.

Raj has extensive expertise in managing the problems that small businesses encounter and delivering long-term results.

RBizz Solutions isn't your typical accounting firm; instead, it's a one-stop-shop for most of the professional services small businesses require to stay afloat and expand.

RBizz Solutions is trying to elevate professional services to new heights of convenience, dependability, and effectiveness.

What do We do?

- All commercial and personal clients receive one-stop professional services.

- Making big corporate financial and technical skills available to small firms

- Accounting, tax, compliance, advising, processes, systems, payroll, and recruitment services are some of the services we provide.

- Providing advanced CFO services to small and medium businesses as business partners

Accounting & Bookkeeping

- Key Services

- General-purpose or special purpose financial reports

- Management reports

- Statutory reports

- Board reports

- Bookkeeping and cloud accounting solutions

Wilson Pateras - Business Accountants Melbourne

0384 199 809

Wilson Pateras is a Melbourne-based award-winning accounting practice. Wilson Pateras was founded in 2009 by Chris Wilson and Nicholas Pateras to provide accessible, competent, and trustworthy financial expertise in the areas of taxation, business consulting, loans, financial planning, and Self Managed Super Fund (SMSF) management.

Intuitive and strategic, Pateras, Wilson, Chris Wilson and Nicholas Pateras manage a team of skilled accountants, bookkeepers, financial consultants, and SMSF specialists who take a holistic approach to your company's and personal financial success. Chris and Nick realise that being engaged in authentic work is the hallmark of a life well-lived, with a vision that extends far beyond the foundations of accounting and compliance.

Our Specialisations

Wilson Pateras specialise in financial advice for high-income executives, including lawyers and medical professionals, and small to medium-sized businesses. To unlock potential in our clients' lives, Wilson Pateras make available a variety of expert services to take care of their immediate financial concerns whilst planning for wealthy, happy futures.

- Small to Medium-Sized Businesses

- High Net Worth Individuals

- Accounting for Lawyers

- Medical Accounting

- Real Estate Accounting

Accounting Services for Businesses

We can create a business accounting services package to meet your organisation's needs and budget, from simple tax returns to complex concerns. Our Melbourne company accountants can help you with:

Tax Advice and Planning

Minimise the amount of business tax you have to pay with smart, legitimate strategies.

Financial Reporting and Statements

Access to your business's financial performance when you need it.

Business Advisory

Get essential strategic business advice to help you to make critical business decisions.

Company Setup & Structures

We can help you set up your company or restructure it when it's time to scale up.

Bookkeeping & BAS Lodgement

All bookkeeping services record your business transactions accurately and on time.

Government Grants Applications

Technical expertise in maximising any potential tax offsets for innovative business'.

What Makes Our Accounting Services Exceptional

Fixed Price Accounting

We offer accounting service packages with a fixed monthly fee structure. There are no hidden extra costs.

Award-Winning Firm of the Year Australia Wide

We are very proud to have consistently been recognised as a leader in the accounting and financial services industry.

Availability

Questions regarding your business? Have the confidence to contact your accountant whenever you need to.

Data Security

Rest assured that your business' data will be kept confidential and secure with our first-class IT protection.

Mark Daniel & Co. - Business Accountants Melbourne

0398 879 278

Mark Daniel & Co was established with the goal of providing our customers with the services they require to advance in life. Whether you require assistance with your business or personal finances, we are here to help. We work side by side with our clients to make sure you get the most out of every dollar you spend and earn. We have years of experience in large corporations as well as small businesses, and we wish to share our knowledge with you.

The Mark Daniel & Co Journey

With decades of experience assisting businesses and individuals in their growth. Regardless of the industry they serve, we have perfected the talent of understanding business and individual requirements. Our clients range from individuals and small businesses to larger enterprises looking to expand internationally.

We've assisted entrepreneurs in establishing firms, expanding into new markets, and increasing their financial growth. Mark Daniel & Co is a public accounting firm based in Melbourne's south-eastern suburbs. MDC provides services to individuals and businesses throughout Australia, collaborating with business partners to achieve the client's goals. MDC has made it its mission to provide the best possible service to its clients while also cultivating long-term business connections.

Mark Daniel & Co are cutting-edge accountants who deliver great client experiences through collaborative technologies and the flexibility to connect with an advisor from anywhere in Australia. Our ability to work remotely as well as in a regular office setting gives our clients the freedom to interact with us, whichever they want. We thrive on educating our clients about financial literacy so that they may better manage their businesses and finances. We are tax experts that are always up to date on the newest developments in tax legislation, which we keep our clients informed about on a regular basis.

We also enjoy giving back to the community by assisting local clubs and sporting groups in fostering a sense of solidarity for the future of these organisations.

We aren't just any accounting business; we are the accounting firm of the future.

BUSINESS ACCOUNTING AND TAX

Let's face it, no one likes or enjoys the process of filing their taxes each year. MDC can help with that. We take the stress out of tax season for both large and small businesses by ensuring that your tax obligations are properly and punctually prepared. You may rest assured that your tax issues are in good hands when accredited professional accountants handle them.

We look at how small business tax incentives, such as the Small Business CGT discounts, can help you when selling a business asset. We take pleasure in our tax experience for small and medium-sized enterprises, which allows us to advise them through any tax or accounting challenges they may have. Businesses must file their Business Activity Statements (BAS), Instalment Activity Statements (IAS), and other tax requirements by specific dates. We'll keep you updated and make sure you have everything you need to stay in compliance with the ATO.

We have experience with various types of businesses, including sole traders, trusts, corporations, and partnerships. Don't hesitate to call us for a consultation on all elements of business, accounting, and taxation for your company.

SKD Partner - Business Accountants Melbourne

0396 507 673

We have offered consulting, compliance, and assurance services to private, publicly traded, and international technology, financial, manufacturing, pharmaceutical, media, gaming, and casino companies in Australia for the past 25 years. We've also worked with international companies involved in shipping, property development, and banking in Asian countries.

AUDIT & ASSURANCE SERVICES

Jacky Mak, the manager, holds a Bachelor of Commerce degree from Melbourne University and is a member of CPA Australia. On audit and assurance projects for private and publicly traded firms, Jacky and his team collaborate closely with the Principal. To manage assurance engagements, Jacky is able to assemble all expertise and help from within and outside the practice to ensure effective outcomes for clients and compliance with the firm's Company Audit Registration with ASIC.

Prior to joining SKD Partner in 2010, Jacky worked as a corporate accountant and assistant company secretary for an ASX listed firm. Through the firm's professional membership with the Chartered Secretaries of Australia, Jacky keeps up to speed on governance and statutory requirements (CSA). The CSA is the foremost professional organisation for governance and risk management.

Service Areas

Financial Statements Audit / Financial Reporting / Internal Controls Review / Cross-Border Due Diligence / Facilitate External Audit Process / GST Compliance Audit / CbC Reporting / Cross-Border Business Migration Audit / Corporate Governance Advisory / Corporate Risk & Compliance Advisory

TAX & BUSINESS SERVICES

Carl Ko, the manager, holds a Bachelor of Commerce degree from Monash University in Australia and is a member of CPA Australia. Carl joined SKD Partner in 2011 and has been managing a young professional team to assist clients with diverse corporate, accounting, and tax concerns using his up-to-date knowledge gained via the firm's professional membership with the Tax Institute. Carl is in charge of making sure that all interactions follow our Registered Tax Agent requirements and other rules.

Carl has the knowledge and resources to assist local and international clients in establishing enterprises in Australia, as well as providing guidance on appropriate business and financial structures. Through the firm's professional affiliation with the Financial Services Institute of Australasia, Carl keeps up to date on a financial advisory (FINSIA). The Financial Services Industry Association (FINSIA) is the industry's primary professional organisation.

Service Areas

Tax & GST Returns / Accounting & Bookkeeping / Company & Trust Set Up / Business Planning / Business Licensing / Financial Modelling / Business Feasibility Analysis & Market Research

Nobel Thomas - Business Accountants Melbourne

0386 796 553

Simple. Transparent. Effective.

You should concentrate on the most critical aspects of your business. Finding new possibilities. Recruiting new employees. Make strides to expand your company.

Allow us to handle the complexities of accounting, finance, and taxes on your behalf. We specialise in it. It's what keeps us going.

- Transparent Fees.

- Expertise

- We listen and educate

With our clients, Nobel Thomas Business Accountants places a high value on ethics, professionalism, and trust. We've consistently created and extended our accounting firm throughout the years, expanding into significant regions. We have the knowledge and experience that textbooks and handling a few accounts cannot provide.

You can trust a Nobel Thomas team member or bookkeeper to handle your account because he or she has years of expertise, knowledge, and insight.

We're A Full-Service Melbourne Business Accounting Firm

Mert and his current Nobel Thomas team have successfully created an outstanding reputation as one of Melbourne's best accounting businesses for over 20 years. Working with small, medium, and big enterprises, as well as huge franchise chains, is our main focus. Property investment and construction are also areas where we excel.

We provide a full range of professional and experienced accounting services to businesses of all sizes and in a variety of sectors. We are well-equipped to deliver a customised solution based on your unique needs and problems.

We are a team of highly proficient and seasoned accountants and can help you:

- Assess your internal accounting requirements/systems;

- Provide assistance with data management;

- Prepare your Business Activity Statements, Payroll Tax, Fringe Benefits Tax & Worker's Compensation Compliance requirements;

- Provide assistance with queries from statutory authorities;

- Provide regular monitoring & analysis of your cash flow, profit performance & balance sheet strengths & capabilities.

Avoid the stress and difficulty of always meeting deadlines and staying current on new legislation and policies that may affect your company. Nobel Thomas provides you with peace of mind by assisting you with the following:

- Preparing your taxation requirements and keeping you up to date with lodgement deadlines;

- Advising you on your superannuation obligations;

- Preparing margin and ratio analysis;

- Preparing monthly accounts;

- Preparing required financial reports.

With a planned strategy, you may increase the value and viability of your business, as well as build and safeguard your wealth. With the following services, Nobel Thomas can help you defend your best interests from start-up to succession:

- Determining appropriate business structure (start-ups and restructures);

- Evaluating the impact of business strategies on cash flow, profitability and security;

- Providing business valuations;

- Preparing exit, transition and succession plans;

- Offering expert advice on buying and selling businesses;

- Negotiating contracts;

- Applying for grants and business incentives;

- Managing budget and cash flow and preparing profit projections;

- Assisting with capital and finance applications;

Alexander Bright - Business Accountants Melbourne

0386 585 823

Small enterprises, start-ups, medium-sized businesses, and individuals all benefit from our qualified accountants in Melbourne. Our team of committed Personal Tax Accountants, Business Accountants, and Business Advisors work tirelessly to stay ahead of the curve by employing best practices and cutting-edge accounting software.

Tax Accountant Melbourne

Our Melbourne CBD tax accountants and company accountants provide a range of accounting services to Melbourne and Australian business owners, all of which are designed to assist them in fulfilling their tax compliance obligations.

To help our clients pay less tax, our tax agents can prepare tax returns, IAS and BAS lodgements on their behalf, as well as to conduct pre-emptive tax planning and tax strategies that allow businesses to keep more of their hard-earned money through tax efficiency.

Accounting Services for Small Business

When it is not practical, start-ups, small enterprises, and medium-sized organisations do not need to hire a team of full-time business accountants and bookkeepers. Our Accounting Practice provides accounting services to small, start-up, and medium-sized businesses, including accounting administration, tax preparation, financial reporting, and record-keeping, among other things. Our accounting services allow business owners to spend more time focused on their daily operations while we handle the finances.

What We Can Help You With

- Income tax returns

- Tax deductions

- Tax refunds

- Tax advice

- Tax Preparation

- Bookkeeping

- Investment property matters

- Business Advisory

- And more

Types of Businesses We Serve

- Bars, Restaurants and Cafes

- Travel and Tourism

- Events, Media and Creative

- Healthcare, Wellness and Leisure

- Professional services

- Real estate and Facilities Management

- Information Technology

- Education and Learning

- Sole traders

- Company

- Trusts

Why Choose Us?

- Our dedicated accountant will listen to you and learn about your individual or business's specific financial needs.

- We produce informative and actionable financial reports that will help you make better financial or business decisions.

- We're capable of handling all matters pertaining to payroll, accounts receivable and accounts payable.

- We ensure you have a complete understanding of your business's financial situation and how any issues can be resolved.

- We can save you countless hours by taking care of your finances.

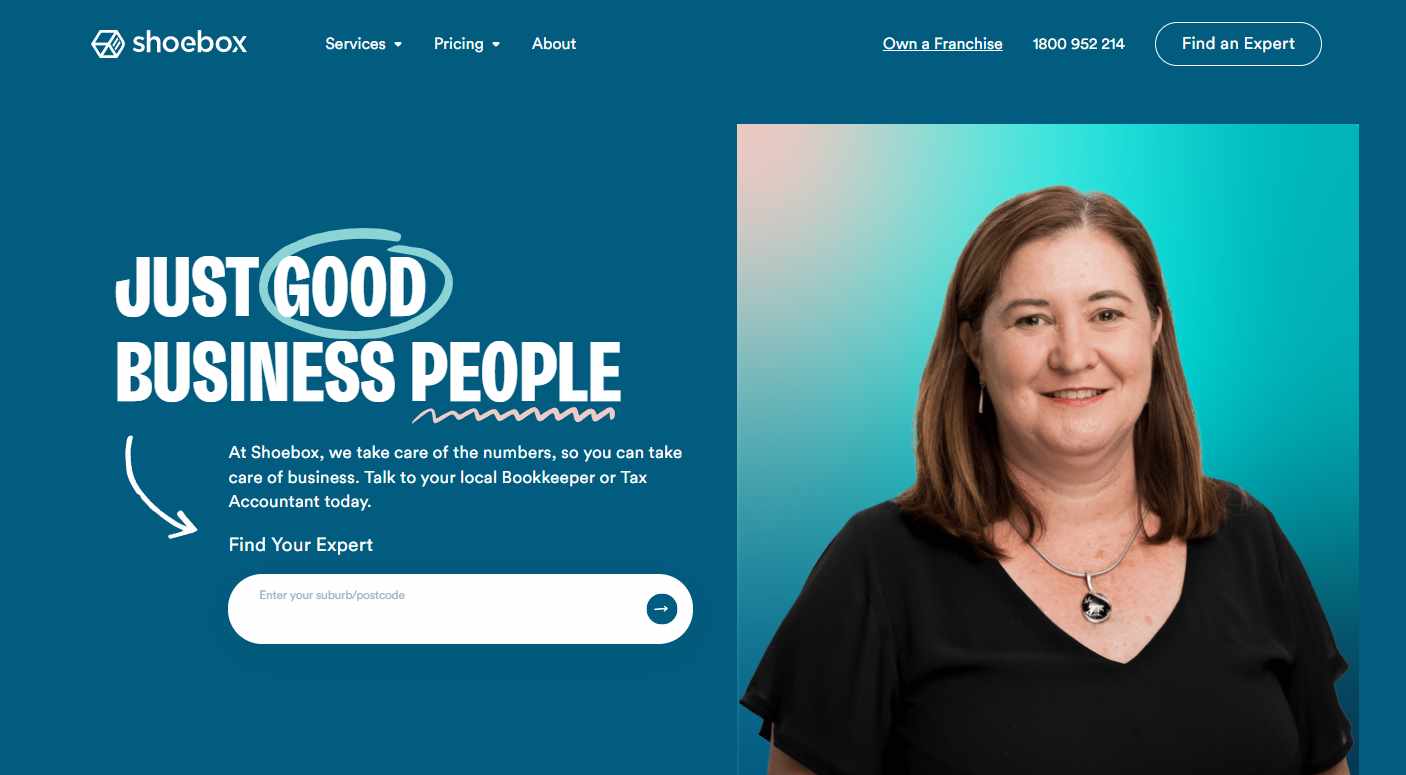

Shoebox Books & Tax Ferntree Gully - Business Accountants Melbourne

1800 952 215

BUSINESS SPECIALISTS BY CHOICE

We know what makes small businesses tick because we are a network of small businesses. But the true reason we focus on SMBs is that we're passionate about getting to know the people behind the companies, which makes us even more involved in their growth and success.

WE GROW WITH YOU

We believe that when you're free to focus on what you're really good at, you'll organically grow. Our adaptable approach to tax and bookkeeping means we can adapt to your changing business demands and develop with you, whether you're just starting out or expanding your empire.

JUST GOOD BUSINESS PEOPLE

Great relationships are the foundation of great service. We work hard to earn the trust of our clients by being proactive, curious, and enjoyable to work with (yep, we just used the word fun to describe a number-cruncher.) We're a group of friendly, hardworking professionals who follow through on their commitments and act with honesty.

TAX & ACCOUNTING

We know better than anyone how difficult taxes can be. Because the Shoebox network includes qualified accountants and registered tax agents, you can rest assured that whatever your tax needs are, they will be met. It is best to plan your taxes throughout the year so that you are not overburdened with tax concerns and costs.

TAX RETURNS

Here, we keep things simple. We can help you plan, prepare, and file your tax returns, no matter how complicated your situation is (both business and individual).

TAX ADVICE

Our duty as a tax and accounting firm includes assisting you with various tax circumstances. We'll give you sound tax advice and assist you in putting it into practice.

BUSINESS ADVISORY

Tax and accounting specialists provide real-world, professional company advice. We'll assist you in developing, implementing, and managing business and financial strategies.

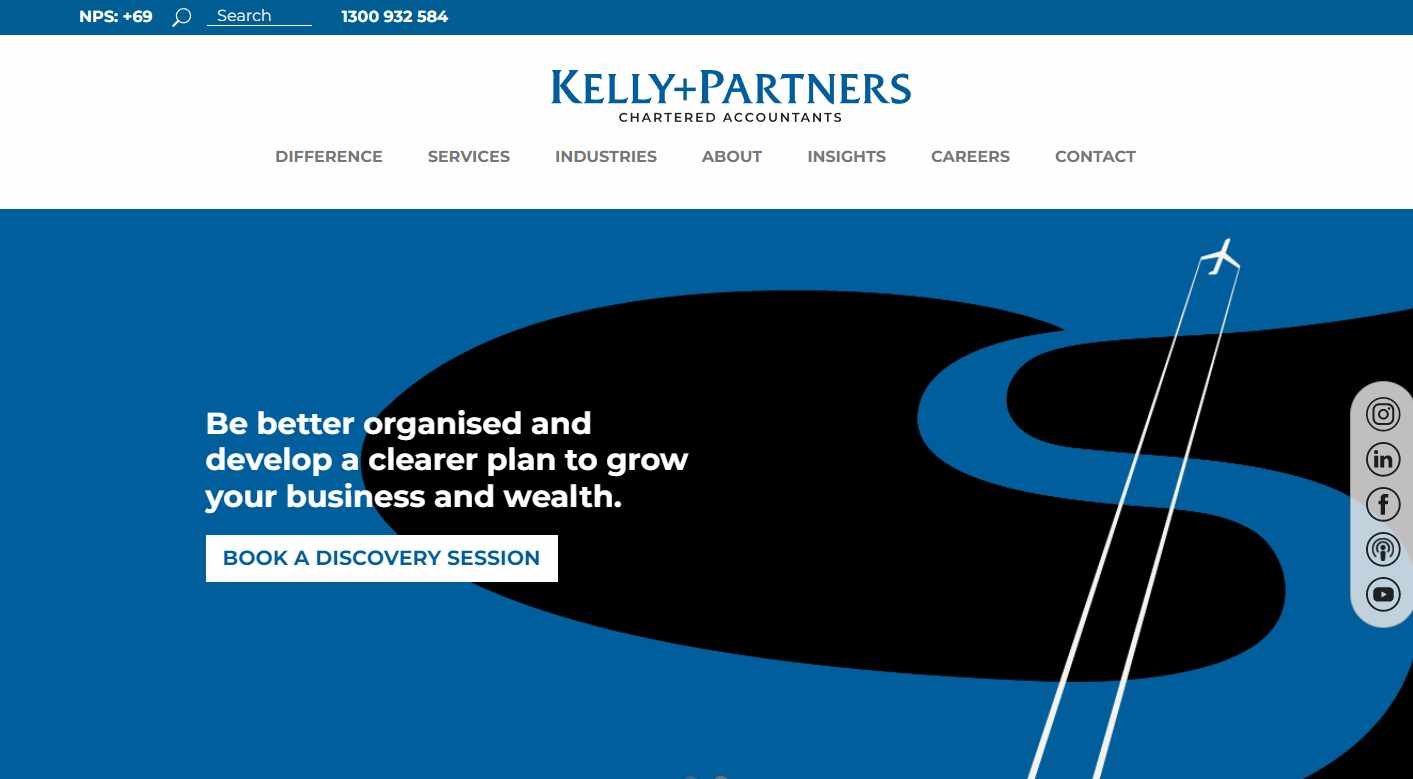

Kelly+Partners - Business Accountants Melbourne

0396 296 745

Kelly+Partners was founded with the goal of assisting small businesses looking to expand.

Kelly+Partners was founded 15 years ago by Brett Kelly from a single Sydney office. We traded our way through the Great Recession as a team, eventually growing into the top national accounting business we are today.

Today, we're a multi-award-winning financial services organisation with the goal of improving the lives of our clients, communities, and people. We help over 8,500 small company owners, high-net-worth individuals, and families create and grow exceptional businesses while protecting their legacies across generations with 17 locations and over 300 team members.

Our close-knit staff is dedicated to assisting you in gaining control of your complete financial world and overcoming any challenge you may face now or in the future.

Don't take our word for it; see for yourself. Learn more about how our clients' lives and businesses have changed by clicking here.

We only work with Private Business Owners.

With our innovative Kelly+Partner's Financial Flight Plan System, we can assist you in understanding how to accomplish and surpass your goals while also safeguarding and enhancing your financial position. Our staff of skilled business accountants is dedicated to your success, so you're in excellent hands.

Business Accounting Services

When businesses deal with company accountants that are just as ambitious as they are, they not just develop but thrive. With our Kelly+Partners offices around Australia, you can see the difference a skilled accountant can make. We're ready and able to assist you, your company, and your family is becoming more successful.

Business accountants who want to help you to thrive

We can help you get clear on your goals at Kelly+Partners so that your business (and your life) are on the correct track. Here are some of the services that our knowledgeable business accountants can provide:

- Business Audit

- Business, Personal and Investment Structures

- Cloud Accounting

- Corporate and Management Services

- Estate Planning and Management

- Family Law Assistance

- Full-service Accounting

- Outsourced CFO Services

- Payroll Services

- Philanthropic Services

- Strata Accounting and Tax

- Tax Audits, ATO Investigations and Disputes

- Taxation Advice and Compliance

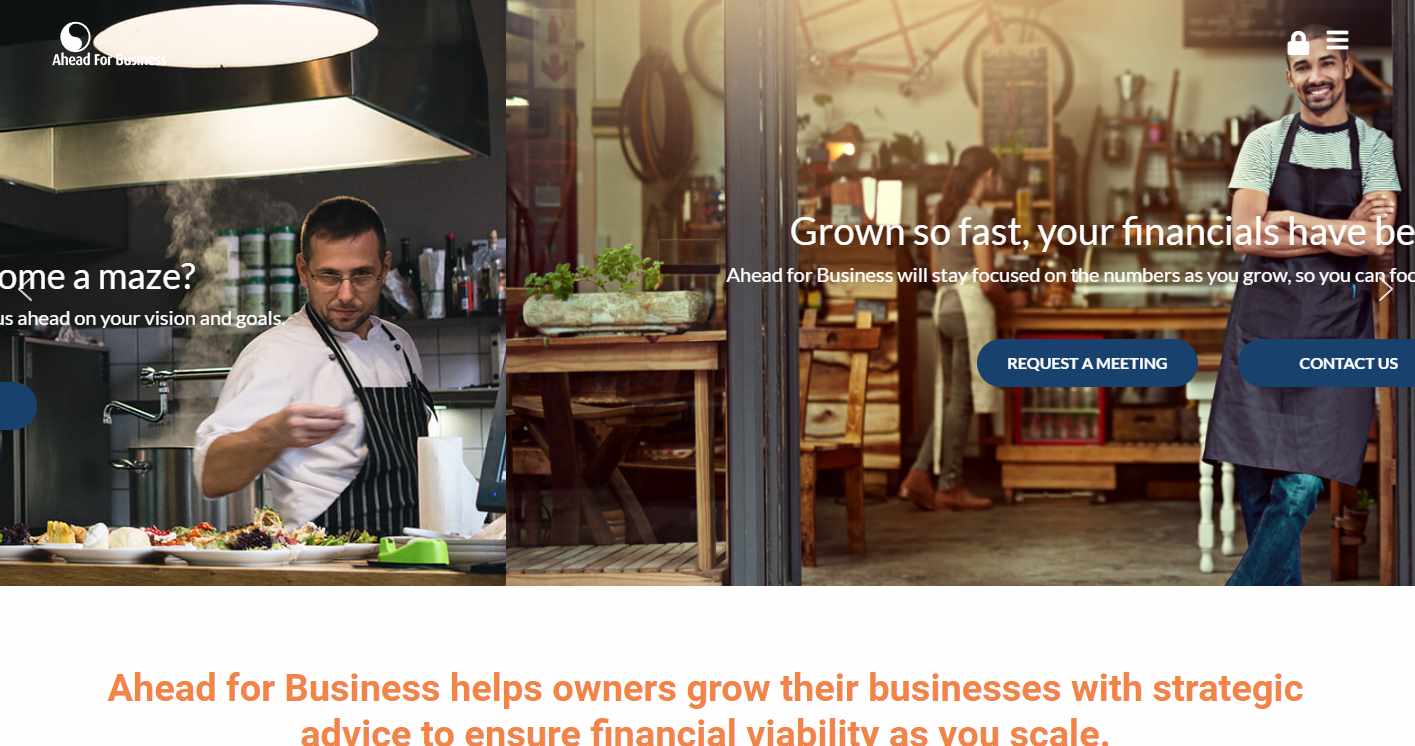

Ahead For Business - Business Accountants Melbourne

0398 677 712

As a small business owner, you understand the importance of having a helping hand when it comes to expanding your company.

We've been providing business accounting and bookkeeping services to companies exactly like yours for over 30 years. But we've also served as a trusted financial advisor to a number of firms, helping them stay on track for success. We've helped hundreds of entrepreneurs and business owners, just like you, as their companies grew and evolved.

We assist you in defining a solid financial plan that can grow with your firm, from advising on your business structure and cash flow management to offering small business bookkeeping solutions and tax guidance. We can also help you with business succession planning, whether you're purchasing, selling, or merging your company. We can even assist with business and company valuations, so you know exactly what you've accomplished.

We're ready to assist you with business planning, accounting services, tax planning (including the preparation of tax returns), and generally keeping your financial affairs in order so you can focus on what makes your firm successful. As a result, we are Melbourne's number one choice for small business accountants.

Audits & Forensic Accounting

Company Audits, NFP Audits & SMSF Audits

Audits can be stressful for business owners because they require time away from your already hectic schedule, especially if this is your first time having your financials audited. Ahead for Business is ready to make your life easier and the auditing process less stressful. We make certain that you are constantly informed about the audit's progress and that every communication is clear.

We have more than thirty years of expertise performing audit and review audits for businesses as required by law, as well as mandatory audits for self-managed super funds (SMSFs) and not-for-profit organisations as needed by their charter.

In addition, a number of our clients hire us to do financial system and procedure audits to ensure that their business has adequate internal controls in place to protect its assets.

Finally, businesses are sometimes compelled to be audited owing to legal issues.

Ahead for Business can help with any of these sorts of audits, as well as specialised audits for specific industrial sectors, including solicitor's trust accounts, licenced dealers, and financial services licences.

Management Accounting

Data, Reporting and Analysis

At Ahead for Business, we specialise in management accounting. We are a true accountant for your company, assisting you in achieving profitability as you expand.

We use automated monthly management reporting to ensure you have the most up-to-date financial data at your fingertips. We can assist you in making these reports easily accessible via cloud solutions so that everyone on your team is up to date, no matter where they are.

Our goal is to assist you in making the best decisions possible at the right moment, based on the most up-to-date facts and analysis of your situation. These monthly management reports contain essential drivers that are critical to the company's success. They are usually non-dollar statistics that are simple enough to recognise and track so that you can make quick adjustments and self-correct to meet your objectives.

The total number of hours in a day that can be charged to a consumer is one example. It's easier for employees to track and record time than it is to convert it to dollars.

Regular management reporting will assist you in increasing productivity, making price decisions, analysing the profitability of various products and service offerings, determining margin trends, isolating profit and cost centres, and consolidating financial data from various entities.

We can help you compare your company's performance (e.g. gross margin, staffing numbers) to that of other companies in your industry by benchmarking your financial data against credible subscriber data.

Forecasting and Budgeting

We'll assist you with developing realistic annual, quarterly, and monthly budgets, as well as cash flow predictions, which are crucial to business operations and management decision-making.

Budgets are the foundation for creating goals, and they must be flexible and adaptable as circumstances change. We will show you how budgets may assist foster team alignment and involvement in your intended goals, despite the fact that budgets are frequently seen as a negative sign.

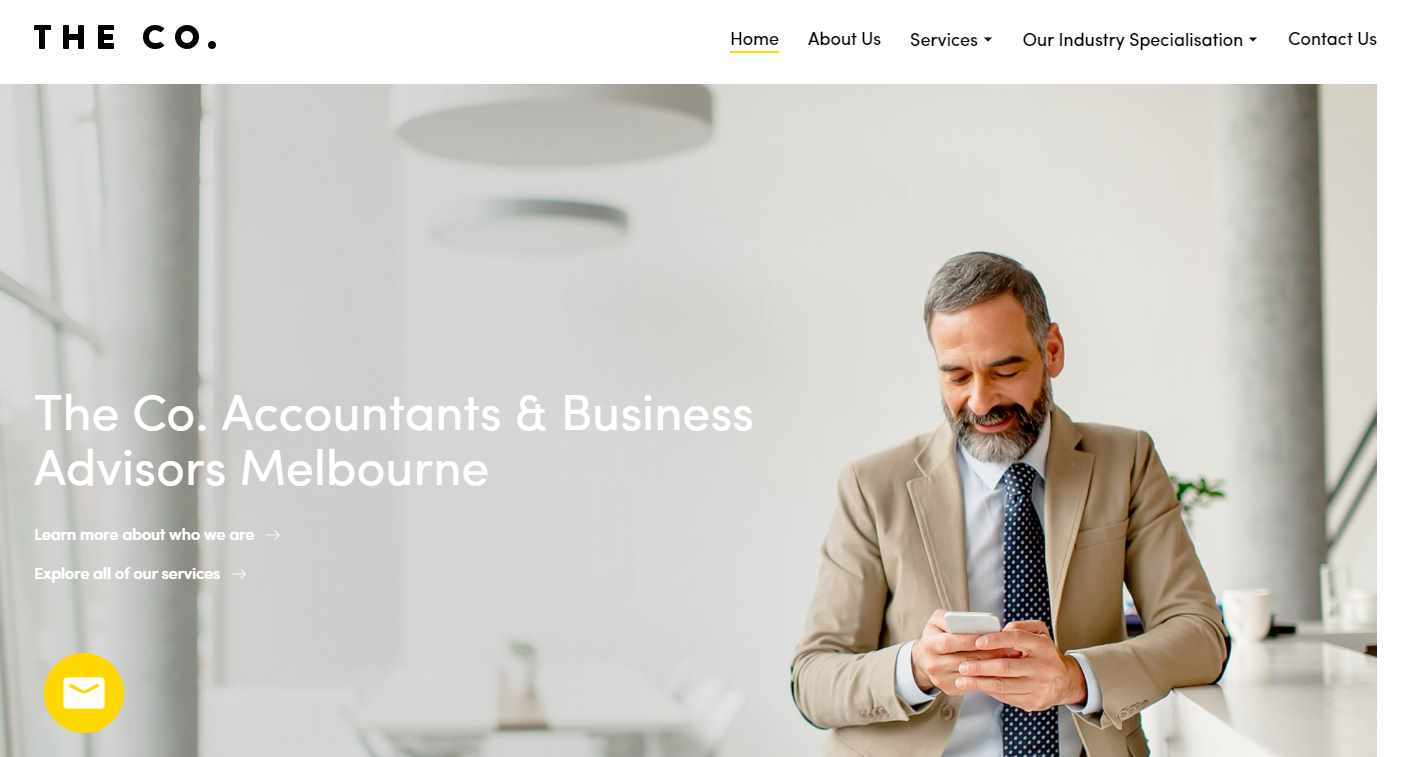

The CO. Accountants - Business Accountants Melbourne

0384 889 809

With over 22 years of combined industry expertise, we are pioneering providers of comprehensive accounting and business advisory solutions based in Melbourne. We provide a wide range of highly customisable financial advice and solutions based on trust, efficiency, and thorough research, as well as our strong financial and accounting expertise. We're here to make sure your company has the best chance of succeeding!

We also enlist the help of our financial brokers and planners, as well as legal advisers, to provide you with customised solutions that are tailored to your business model and budget.

Peter Mercuri, a seasoned Director, is in charge. Peter has a 360-degree understanding of functional business dynamics and the complexity of the accounting world, thanks to his breadth of knowledge and experience.

For almost a decade, Peter and his staff at The Co. have been delivering excellent accounting services and business advice. SMEs and larger firms, as well as a variety of professional service-based sectors, benefit from our effectively implemented financial services. Building and construction, food and processing, mining, manufacturing, pharmaceuticals, and high-net-worth individuals are just a few of the industries where we have happy clients.

WHAT WE OFFER

Accountants Melbourne Recommend The Co. Accountants provides unbiased counsel based on well-established research methodologies by specialists with extensive industry experience. We place a major emphasis on our clients and provide more than just a report or analysis. We endeavour to give expert advice and support based on our economic expertise while ensuring that our customers have access to all relevant data and information.

What We Will Do For You

Our highly qualified team of accountants will collaborate to identify tax-effective alternatives and assist your company in successfully implementing them while minimising risk and adhering to tax rules. We take the worry out of the equation and make sure you're taken care of as part of our tax compliance and consultation services.

With increased regulatory and expense demands, having a solid understanding of tax compliance has never been more important.

Let us advise you and manage your tax compliance to reduce your company's risk.

Tax Accountants

The Co. Accountants in Melbourne team will ensure that all your tax compliances are in check with the relevant regulatory bodies such as:

- Australian Taxation Office (ATO)

- State Revenue Office (SRO)

- Australian Securities and Investment Commission (ASIC)

- Business Activity Statements, Instalment Activity Statement (IAS), Superannuation, Payroll Tax, Land Tax, Fringe Benefits Tax

Tax Strategies and Planning

Tax Planning

We do a thorough evaluation of your company and examine all financial operations. From the start, our due diligence is an impartial norm. We follow all applicable norms and regulations, and we offer guidance on how to structure your business and your personal life in the future.

Structuring

Checking that you have appropriate structures in place throughout your entities for both current and future outcomes will provide you with the flexibility you need to minimise your tax exposure for current and future generations.

Let's work together

Our Melbourne CBD accountants are dedicated to determining the underlying purpose of your company. We can communicate much more than just the facts by combining this insight with expert expertise and support. At The Co. Accountants, we take pleasure in becoming a trustworthy partner who is invested in your company's success.

The Co. Accountants provides world-class business accounting and financial planning services with a local flair, with a broad mix of professionals and industry-leading advisers available when you need them. We give an eclectic mix of offerings to our clients as forerunners in the space: from bookkeeping to tax compliance to business advisory to outsourced CFO services. Our entire suite of services and multi-faceted approach ensure long-term improvement.

Remember that we're not like the other competitors. We genuinely care about our clients' success. It's about much more than fantastic stats for us. We believe in establishing long-term connections while delivering great outcomes that set you apart from the competition. This collective team attitude enables us to zero in on your difficulties with a laser-like focus that adds the most value to your company.

Bruce Edmunds & Associates - Business Accountants Melbourne

0395 895 489

Bruce Edmunds has a long history of providing excellent service to clients, having been founded in 1966. We are Melbourne-based business accountants who provide businesses and individuals with expert taxes and financial planning assistance.

Business accounting, in particular, is concerned with the future. It focuses on constructing a realistic image of your company's current state, performance, and financial health.

You have the right materials to undertake long-term planning, strategise, and analyse progress towards your business goals, thanks to the information provided by your business accountant.

With a business accountant on your side, your company will have more than just statistics and data to make decisions — our staff has extensive expertise in assisting business owners with long-term planning.

We'll use our experience to advise you on the best course for your company and provide an executable plan to get you there.

Small Business Accountant

There are a lot of things that small business owners would rather do than deal with money. Remove the financial and tax load with a small company accountant who takes the time to learn about your current business and your goals for the future.

You already have a lot on your plate as a business owner. Our Melbourne small business accountants take the weight off your shoulders. We offer a variety of accounting services, such as:

- BAS & IAS lodgements

- Bookkeeping services

- Financial statements and reporting

- Tax audits and returns

In addition to helping existing businesses, we also provide assistance for new ones.

We help prospective business owners decide on the most suitable business structure and assist with the essential administrative work that lays the groundwork for your business.

Personal Account Melbourne

Organising your personal finances can be tough, especially if you have many sources of income or are eligible for a variety of deductions and allowances.

In 20 years, where do you want to be? Retired? Travelling around the globe? Do you have enough passive income to work part-time?

Whatever the dream is, Bruce Edmunds' financial advisors can help by:

- Managing your superannuation

- Growing your nest egg

- Managing investments

- Reviewing your portfolio

- Crafting wills and performing estate planning

Get to where you want to BE with Bruce Edmunds.

Accounting is about more than numbers; at Bruce Edmunds, we think it should be about assisting you in growing and realising your goals, whether they are in business, personal wealth, or retirement.

Accurate accounting and expert financial counsel, according to our Melbourne accountants, are the keys to attaining this.

When you work with our knowledgeable staff, you'll get more than just tax advice; we'll also provide a variety of personal and business accounting services to help you plan for the future.

Whether you need assistance with your business or personal finances, we will collaborate closely with you to make your idea a reality. Tell us where you want to go, and we'll assist you.

Abound Business Solutions - Business Accountants Melbourne

0390 714 009

Anthony Brown founded Abound in 1993. The practice concentrated on accounting and taxation services, offering full-service capabilities in these areas to its clients. Richard Brown founded Abound Financial and Lifestyle Planning in 1995 as an affiliate business.

We are a firm with a long history of assisting clients in achieving their commercial and financial objectives.

We believe in building long-term relationships with our clients by assisting them in growing their businesses, profits, and personal wealth. We preserve your assets by implementing a long-term strategy that lays a solid platform for future growth.

We are the organisation to go to as your trusted advisor if you are planning to establish a new business, need loan assistance, have tax compliance, or have difficult financial challenges to handle.

Anthony, Tanya, and Keith, partners, have over 60 years of combined expertise and can provide you with a safe set of hands when it comes to realising your dreams.

Business Services

Regardless of how big or little your company is, it demands your ongoing attention and skill. The attention to detail required in building your structures, as well as the day-to-day compliance required in any organisation, can easily distract you. We can handle everything so you can focus on what matters most: your business.

Accounting / Management

Getting your accounts in order will benefit you much. We collaborate with you to create a service that is suited to your company's needs.

Abound can handle your accounting needs on a monthly, quarterly, and/or annual basis by providing:

- Detailed accounts, including Profit & Loss statements, balance sheet reporting and cash flow statements

- Desktop reporting is ideal for management and/or board meeting processes

- Detailed analysis & interpretation of your reports

- Business dashboard and KPI analysis

- Budget preparation and analysis

- Variance analysis against budget and previous years' results

- Quarterly client meetings to provide more detailed analysis

Reliable Melbourne Accountants - Business Accountants Melbourne

1300 049 535

As one of Melbourne's top accounting firms for the past 12 years, our services and commitment to clients have inspired and pushed us to expand across Australia. We recognise that filing tax returns, as well as receiving tax refunds, is one of your top objectives for completing your obligations for the current fiscal year.

We ensure that all of your arguments are considered and that we "Maximise your Refunds" * at a cheap rate, with our best tax trained and professional employees. We respond to all enquiries received from the Australian Tax Office (if any) following the tax filing.

We will advise you on how to meet your remaining tax responsibilities and the best approach to save money for the coming fiscal year in terms of deductions and rebates that apply to you based on your profession.

We also examine depreciation schedules for assets purchased during the fiscal year, whether it's a car or any other piece of equipment for which tax laws apply.

There may be times when your tax returns need to be changed or revised in response to ATO inquiries, in which case we assume full responsibility for completing your requirements.

Professional Accounting Services by Qualified Accountants

Accounting Services to your Business Growth

Accounting is an important part of every business. Accounting services help firms keep track of their finances and manage future transactions. We guarantee that our clients will receive error-free accounting and financial stability.

We have been providing accounting services in Melbourne for many years (Australia). We recognise the intricacies of the situation. Accounting, forensic accounting, tax preparation, transactional accounting, payroll, bookkeeping, financial planning/advice, cash flow management, and commercial and consumer credit services are among the services we provide.

Outsourcing Australian accounting services to skilled accountants reduces overhead costs significantly. With Reliable Melbourne accountants, you can rest assured that you will receive comprehensive accounting services that will suit all of your accounting requirements.

We've already made a reputation for ourselves in the accounting industry. We did so with skill and confidence in our team's abilities. We ensure that the businesses we work with follow the ATO's regulations, laws, and guidelines. We keep our clients informed of any new rules, and we guarantee high-quality accounting services in Melbourne.

Our Accounting Key Services Include

Cash Flow Management Services

For any company organisation, managing cash flow is one of the most difficult responsibilities. We guarantee our client's error-free cash flow management services with our team of qualified accountants. For this reason, we monitor incoming and exiting funds in the business on a regular basis. This is beneficial when it comes to paying taxes. Also, it explains how we can save money on taxes and put it to better use in our businesses.

FORENSIC ACCOUNTING SERVICES

We are fortunate to have one of the greatest financial specialists and accountants on our team. They are efficient in their work and are capable of detecting any fraud as soon as it occurs. Not only are frauds caught early as a result of data analysis, but it is also possible to foresee any other issues that may arise in the future.

This is an indirect technique to reduce the additional strain that may exist during tax payments.

PREPARING FINANCIAL STATEMENT

Our staff of highly qualified accountants and financial specialists can generate accurate income statements, cash flow statements, and balance sheets, as well as provide clients with accurate financial preparation services. Everything is done in such a professional manner that there is no possibility of making a mistake when paying taxes.

Tax Processing Services

Because our highly qualified accountants work with many Australian accounting businesses, we are familiar with tax processing services and can provide the best to our clients. The major focus is still on the tax return and making arrangements for the future. The activity is primarily completed while according to government norms and regulations. Our specialists can also provide you with suggestions for future investments that will benefit the company's growth.

Payroll Processing Services

We provide high-quality payroll processing services to our clients, including bonuses, salaries, commissions, and other money transactions that are calculated after taxes. Every employee in the company has their own payroll process. Experts perform this task to obtain the exact computed amount.

E- ACCOUNTING SERVICES

We keep up with the latest accounting tools, technology, and trends to provide superior accounting services in Australia. We provide clients with appropriate online techniques for existing procedures so that manual accounting can be replaced with digital work.

Choosing us to outsource Accounting services to Melbourne would be a wise decision because we not only provide the aforementioned services to clients, but we also customise them to meet their specific needs, and the task is completed by a team of experts only, so you won't have to worry about any penalties or extra payments.

PROCESSING INVOICE SERVICES

We are aware that having an accurate invoice is the most important factor in any industry's ranking. As a result, we provide the same service to clients with better skills and capabilities. Regular bookkeeping ensures that not a single entry is overlooked and that you do not wind up with a mess.

TRANSACTIONAL ACCOUNTING

Transactional accounting includes altering or maintaining structures that are applicable to corporate entities. These type of accounting services involves:

- Acquisitions and mergers

- Corporate finance

- Due diligence

- Prospectus preparation

- IPO (Initial Public Offers)

- Venture Capital

Rubiix Business Accountants - Business Accountants Melbourne

rubiixbusinessaccountants.com.au

0396 030 067

Rubiix Business Accountants is a full-service accounting firm situated in Melbourne that provides a wide range of accounting and taxation services to companies of all kinds.

We have more than 30 years of experience and a team of qualified accountants, tax agents, and bookkeepers with experience in a variety of businesses. Our customers come to us from all throughout Australia, New Zealand, and the world. In all elements of taxation and corporate accounting, we are experts and extremely skilled.

We work with small and medium-sized family businesses, superannuation funds, a variety of organisational forms, and high-net-worth individuals. We build all aspects of our client's financial needs to reach their goals and restore the balance they desire through strong client relationships.

Rubiix Business Accountants' purpose is to provide you with a customised solution to meet your unique business needs and assist you in achieving your financial objectives.

Enviable Workplace Environment At Rubiix

Rubiix's success is based on the satisfaction of its employees. We are in one of those rare and ideal situations when we look forwards to going to work. Rubiix fosters collaboration, motivates, rewards, and supports employees at all levels. To achieve the greatest potential outcomes for you, our client, we actively take responsibility for obstacles and frequently look outside the box.

Sharp Focus On Our Clients

All of this translates to excellent and focused client service. We've made a firm commitment to spend time with you to learn about and grow your business while remaining easily accessible. We accomplish this in two ways:

- Business Mentoring: We listen to your needs and concerns and then act on that knowledge to help them achieve their vision.

- Client's Expectations: Part of our daily routine is our desire to deliver results over and above your expectations.

Accounting & Financial Risk Management

Minimising and managing financial risk is the difference between success and failure

Key focus points

- We help you minimise risk.

- We can help identify, assess, control or avoid risk in your business.

- With proven applications, the impact of risk is minimised or even reduced altogether.

- Audit insurance is available.

We can assist with structuring and agreement resources

We keep you abreast of Australian Tax Law

The difference between success and failure is minimising and managing financial risk. Covering all of the what-ifs in your personal and professional lives will lessen ambiguity while striving for the best outcome.

We'll look for any areas of risk that could prevent us from achieving a better result. Every company should be able to properly identify risks, as well as the likelihood of exposure and vulnerabilities. This is done in tandem with a system for identifying any new opportunities that have developed as a result of changing conditions.

Rubiix Business Accountants can help you develop a financial risk management strategy to help you reduce and mitigate any business risks. Financial risk management is an important but often overlooked aspect of running a successful organisation.

Monitoring how your company is performing in relation to its goals and strategy is critical for determining potential outcomes. Responding positively to any early warning signals by identifying practical solutions to overcome obstacles should be so ingrained in your day-to-day operations that there are no unexpected surprises.

We offer solutions to help organisations build a risk management culture that considers all aspects of risk. This would not only drastically lower stress levels but will also boost company performance and decision-making for all managers.

Opulent Accountants - Business Accountants Melbourne

0388 388 727

All of our clients, whether small, medium, or large, come to Opulent Accountants with the goal of creating, maximising, and projecting wealth. Our success has been built on a reputation for providing exceptional personal service and professionalism. While experience and expertise are important, it is work and enthusiasm that distinguishes the winner.

Opulent provides a comprehensive range of accounting, tax, and mortgage brokering services, with the goal of providing you with customised guidance when your company requires it. We assist you in managing all aspects of your business. And we were able to do it by developing a one-on-one relationship with each of our clients.

We are dedicated to developing deep relationships with our clients, allowing us to better understand their particular situations and tailor the professional support we provide to meet their specific requirements. Small to medium-sized businesses and individuals who want tax accounting and financial services make up the majority of our clients.

We can assist you in managing every element of your company. Our mission is to develop personal relationships with our clients, determine their individual needs, and design financial solutions to help them achieve their goals.

Our Expertise

Our certified accountants at Opulent Accountants are well-equipped with current technology and specialised knowledge to provide you with a wide range of services, including specialist tax counselling, business consultancy services, accounting, and self-managed superannuation fund guidance. Our team is especially knowledgeable about the needs of small and medium-sized businesses and entrepreneurs. From the inception of your new firm to its management and succession planning and preparation, we provide strategic counsel.

Our Services

Opulent Accountants considers small business accounting to be our strongest suit. We've worked with a variety of clients and enterprises with varying needs as the original accounting office for small businesses and startups:

When it comes to your accounting needs, we specialise in:

- Accounting For Small Businesses

- Taxation & Lodgement

- ATO Compliances

- Business Reporting

- Small Business Setup & Advice

- BAS Lodgement

- Tax Planning

Business Accounting Melbourne - Business Accountants Melbourne

businessaccountingmelbourne.com.au

0386 580 727

Melbourne's Accounting, Taxation and Financial Planning Experts

We deliver unrivalled efficiency, expertise, and profitable accountancy solutions to small to medium-sized organisations as well as individual clients.

Personal Accounting Services

In order to obtain the best possible tax refund, each client needs a distinct perspective. There is substantially less "number crunching" than in other structures. As a result, many accountants spend less time with individuals than they do with other clients.

And this is incorrect; while there is less compliance work involved, more time must be spent analysing the client's position with a "fine-toothed comb" and applying every legally possible deduction.

The essential concept is that until the ATO specifies otherwise, an item should be deductible if it is "necessarily incurred in producing assessable revenue." This is where our accountants' value rests.

By having an intimate knowledge of the Australian taxation rules, your Accountant is able to sit down and talk you through the process by explaining:

- What we can deduct

- The maximum we can deduct for certain expenditure

- What records/receipts do we need in order to deduct the expense

We can give our clients the tools and knowledge they need to understand their financial condition and work with their accountants to strategise and implement a plan to develop their wealth while lowering their taxes in future years by educating them.

Tax Services Melbourne

Business Accounting Melbourne features a number of tax agents who are well-versed in Australian law.

We understand that gathering your group certificate, receipts, and records and then selecting a qualified accountant to prepare your tax return in Melbourne can be a stressful procedure, and we strive to make it easier for you.

Our goal is to maximise your tax refund or minimise the amount you must pay.

We offer a variety of tax return services, including:

- Students

- Contractors/tradespeople

- Businesses

- Professionals

- Individuals with complex investments and properties

Some Melbourne tax advisors will devote less time and effort to individual tax returns than they merit, preferring to focus on more complex and higher-paying clients.

Even if some tax returns take longer than others, we guarantee that each client will receive the same high level of service.

We can assist you with several complex areas of the tax return procedure that can land you in hot water with the ATO if not handled correctly:

- Capital Gains Tax

- Negative Gearing

- Uncompleted tax returns from previous years

Marin Accountants - Business Accountants Melbourne

0396 459 228

For over thirty years, Marin Accountants has created a reputation for offering superior accounting and business advising services to our growing customer base. During this time, our company has expanded to include a devoted staff of over twenty accounting and taxation professionals who have built trusting relationships and worked with our clients to help them realise their goals and meet their business objectives.

Each member of our executive team specialises in a different aspect of business and accounting. All client engagements are examined at the outset, and a dedicated team is chosen to ensure the optimum fit for each client's goals. We've had a lot of success with this customised strategy, not just in helping our clients achieve their objectives but also in building long-term relationships as trusted business consultants.

Our client base and expertise cover a broad range of needs and backgrounds, from professional people, families and businesses, including:

- Construction and property developers

- Entrepreneurs

- Family businesses

- High net worth individuals and families

- Legal practitioners

- Medical practitioners

- Small to Medium Enterprises (SME)

- Startup businesses

Marin Accountants in Melbourne offers private consumers, corporations, and families personalised, proactive, and proven tax and accounting services. Our accounting firm is dedicated to providing personalised assistance to each of our clients, who have direct, one-on-one contact with our team of professionals.

Our tax accountants serve South Melbourne, South Yarra, St Kilda, and the surrounding areas, assisting a variety of businesses as well as providing specialised specialist accounting services to the medical, property development, and retail sectors. We also offer superannuation advice, including SMSF setup, asset acquisitions using limited recourse borrowing, and continuous administration and audit services for self-managed superannuation funds.

SERVICES OUR ACCOUNTANTS PROVIDE

Marin Accountants' competent and experienced team of accountants provides specialised accounting and taxation services to a variety of businesses and SMSFs. Tax policy is always evolving, and understanding the complexity of tax law necessitates the expertise of a tax accountant. We have a thorough understanding of tax law and can assist clients in keeping up with developments.

Our accountants also offer tax and accounting guidance to small, medium, and start-up firms. Our team can work with you and provide end-to-end solutions for your business, from helping you write a business strategy through structuring assistance, budgeting and forecasting, and business succession and estate planning. We can also provide superannuation advice and are SMSF experts. Our team of accountants works with customers to develop wealth-building strategies for retirement.

WHY WE ARE THE ACCOUNTANTS FOR YOU

With over 30 years of experience as small business accountants and delivering tax advice and assistance to business owners, the Marin Accountants team can help manage the rigours of business accounting and management reporting.

- financial report preparation

- lodgement of income tax returns

- GST, BAS, FBT,

- superannuation

- payroll tax

- Workcover and other specific tax obligations

- budgeting and cash flow forecasting

Our expert team of small business accountants also work alongside our clients to guide and advise on their business protection and growth, including:

- asset protection

- tax planning

- business restructure and analysis

- business acquisitions

- valuations and appraisals

- buy and sell agreements

- due diligence reports

- Self Managed Super Funds

RA Advisory - Business Accountants Melbourne

0398 130 884

We apply big business financial principles to small businesses, assisting you in gaining control of your profits, remaining compliant, and planning for the future. You'll be free of the worry of managing your daily finances with our assistance. This frees you up to concentrate on what you do best. Our mission is to serve as an extension of your company, giving the financial support you need to realise your business goals.

Business Accounting and Taxation

We understand how business accounting and tax compliance are vital but unpleasant elements of running a business after 12 years of assisting small business owners just like you. To be honest, we understand you have more important things to accomplish, such as expanding your business, spending time with your family, and planning a family vacation.

Unfortunately, as a corporation, you must adhere to legislation, meet constant deadlines, and deal with massive amounts of paperwork. This is where we can help. We can assist you in simplifying your business accounting so that you can keep more of your profits, grow your company, and enjoy your own success.

Business Accounting

You can't manage what you can't measure, which is true. Work with one of our highly skilled accountants to gain a better grasp of your numbers and receive individualised financial advice.

BAS Accounting

We can handle your Business Activity Statement (BAS) lodgement and keep you compliant with the ATO, giving you more time to focus on running your business.

Xero & Cloud Accounting

Xero is the best market-leading accounting software, and we at RA Advisory can set you up with Xero, run you through it, train your staff and be here for assistance whenever you need it.

Tax Planning

It's crucial to get on the front foot and be proactive with tax planning. We build tax planning strategies for both the short term (next 12 months) and the longer-term (next 5 years).

Tax Compliance

Tax compliance requires diligence and proactive work throughout the year. We are always up to date with legislative changes and Australian Tax Office policies.

Business Structuring

How you structure your business can be the difference between a business that can grow in the long run and a business that can't.

PMCA Advisory - Business Accountants Melbourne

0130 0744 548

Grow Profit, Cash and Value in Your Business

PMCA Advisory is a Chartered Accounting firm that helps Australian businesses actively participate in their company's strategic development. We work with our clients to increase profit, cash, and value by using 3-way financial forecasting, analysis, strategic planning, and frequent accountability. Please let us know how we can assist you.

Fixed price monthly fees for your business compliance needs.

Accountants Melbourne

Compliance Services: PMCA Advisory provides monthly rates (no annual surprises) that cover everything from cloud-based software deployment through bookkeeping, payroll management, tax compliance (BAS and Income Tax), financial reporting, and ASIC compliance. Everything you'd expect from an accounting firm - There's more, though.

Re-organise your financial reporting and drive your business towards sustainable growth

PMCA Advisory - Accounting Firm Melbourne

Advanced Financial & Cash Flow Management:

We offer advanced financial and cash flow management services as an add-on to our Compliance Services. You will be able to anticipate the future financial impact of decisions you are considering today using developing technology in real time. This is a significant advancement in small business management.

Allied Business Accountants - Business Accountants Melbourne

0390 974 059

With a varied range of services in Melbourne, including business accounting, business taxation, compliance, business analysis, profit improvement, and tax minimisation, we offer year-round support, advice, and consulting to maximise your profits and help your small business flourish.

Why Work With Us?

Trusted by some of the biggest brands…

We're more than just number crunchers during tax season. We want to be your go-to business advisor, ready to help you with a wide range of business solutions centred on the things that matter most to you.

We'll work with you to understand your small business's unique needs, define financial goals that matter to you, and implement market-sensitive tactics to help you grow your business, develop wealth, and reach your full potential.

Services We Provide

To streamline and maximise every element of your business performance, Allied Business Accountants connects you with a network of top business accounting, legal, and financial services specialists.

- Starting a Business

- Foreign Companies

- Bookkeeping

- Assets Protection

- Virtual CFO

- ABN Registration

- Resident Director Services

- Self Managed Super Funds(SMSF)

- Profit Improvement

- Succession Planning

- Property Investment

- Local Agent Services

- Australian Subsidiary

Clarke & Company - Business Accountants Melbourne

0396 080 709

Clarke & Company is a Chartered Accounting firm dedicated to providing outstanding professional services. Clients continue to receive individualised accountancy and taxation guidance from the firm.

We frequently represent three generations of clients.

A programme certified under Professional Standards Legislation limits liability.

Our Firm

Clarke & Company is a Chartered Accounting firm dedicated to providing outstanding professional services. The firm was founded in 1925 to provide clients with personalised accountancy and taxes guidance and help. Hugh Clarke, the firm's principal from 1945 until his death in 1967, was one of the firm's early influencers. Bernard McMenamin, the current director, joined the firm in 1973 and was promoted to director in 1978.

Clarke & Company has built ties with other highly recognised professionals in their fields of speciality to ensure that customers are directed in all aspects of their affairs, including legal, financial structuring, and investment management assistance.

More than 200 families entrust Clarke and Company with their financial well-being.

Bernard is backed up by a team of 12 people who maintain Clarke & Company's legacy of counselling high-net-worth individuals, medical and legal professionals, and small businesses.

Chartered Accountants

Private Client Services

Clarke & Company advises high nett worth individuals, including investors, professionals, the financial services industry, and small businesses, on taxation, superannuation, estate and inheritance concerns, family continuity planning, and asset planning. We use best practices that are suited to each client's individual requirements.

The practice handles all tax, indirect tax, corporate law, and other statutory compliance issues.

We provide an objective and independent service that, when joined with our in-house family office, results in a completely integrated professional approach.

Family Office

Clarke & Company understands that you have a lot on your plate. Therefore this service is designed to help you with the day-to-day administration and management of your finances. We specialise in delivering a wide range of strategic solutions to help families safeguard, grow, and distribute their money.

Budgeting and cash flow management, risk management, accounting, and document record keeping linked to wealth management, asset structuring, wealth administration, lifestyle planning, and elder support are all provided through private client portfolio services and sophisticated back-office resources.

This, along with our private business knowledge, allows us to give the whole FAMILY OFFICE.

Our Expertise

- Personal Taxation Advice

- Corporate & Trust Business Advice

- Superannuation Taxation Advice

- Estate Planning